How To Value Your Business Right And Prepare A Strategic Future Exit

Incorrect valuation is the biggest problem in selling a business. It stems from the biggest mistake, which is overcapitalization, which then leads to overpricing by the seller, which then turns buyers away until the seller is forced to sell it at a below-market price. So, when selling your enterprise –whether now or in the future– how do you value and price it properly?

It’s best to know the answers to this now if you plan on selling soon. It’s good to know this now, too, if you need to sell it later, so it can guide your current decisions and plans for a strategic exit strategy for the future.

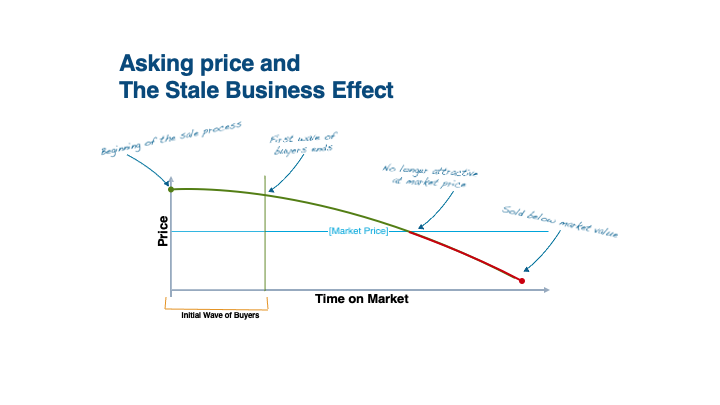

The Stale Business Effect

On average, the process of selling a business takes around six to nine months or 200 working days. In the first three to nine weeks after you put it on sale, there is a high initial wave of prospective buyers, then it tapers off.

If you priced it way beyond the market price during this period, there is a 90% chance of your losing your buyers. So, you will keep dropping your price in the hopes of attracting a serious buyer. But, after nine to twelve months of doing this, even if you already offer at the current market price, buyers will see less value in your business. They will wonder: why has no one bought it after all this time?

So, you are forced to further lower your asking price even below the market price and end up selling it almost as a giveaway. This happens to eighty percent (80%) of enterprises who don’t know how to value and price their business right.

Pricing a business right involves assessing the convergence of the three main components of profits, market, and risk.

In general, Xcllusive Business Sales recommends an asking price of not more than 15% of the market price to sell at the best time, and not prolong the process needlessly. Selling at less than the market value is not selling at all.

Main Reasons For Overpricing

There are three common reasons for overpricing: the seller’s expectations based on their very personal investment in their enterprise, the seller’s not understanding market principles and buyers, and overcapitalization of the enterprise.

“Job Businesses” are Xcllusive Business Sales‘ largest type of sellers. They are small enterprises with annual profits of less than $300,000. They are run by their owners who essentially hired themselves for a job as manager of their own enterprise, where they earn at most fifty percent (50%) more than they would earn as a salaried employee elsewhere. It’s not a passive investment; they are very personally involved in running and growing their business.

When selling their businesses, they consider not only the financial investments they have made but also the personal investment of effort and sacrifices as well as years of their lives invested as a basis for their asking price, which may not be reflective of the value of their enterprise from a market standpoint.

The moment you open the doors of your business, the main driver of value is the profitability of your business, not the personal cost and investments you put into it.

From a business buyer’s standpoint, buyers decide to buy based on the synergistic value your enterprise affords them. This is based on the concept that the combined value and performance of two companies will be greater than the sum of the separate individual parts. So, a buyer will buy businesses to take advantage of economies of scale, new markets, new products, expanded market share, eliminating competition, and increasing prices. How are you, as a seller, offering these values to your potential buyers

From a market perspective, there is the concept of fair market value which is the price that would be negotiated in an open and unrestricted market between a knowledgeable, willing but not anxious buyer and a knowledgeable, willing but not anxious seller acting at arm’s length. From either end, there is no pressure to buy or sell. When these conditions are met, a fair market price is achieved

Zoran Sarabaca, Xcllusive Business Sales principal, shares how people will often say that somebody will pay more for their business because it’s worth more to them. He corrects this impression by clarifying that actually, it is a very rare occurrence, and will probably occur only when someone approaches you to buy your business. In his more than 16 years in the industry, selling more than 200 businesses at high success rates, he estimates the occurrence to have two or three buyers competing for an offer to be only at one percent (1%). Usually, there’s only one serious buyer, and, he points out, “In an open market, it’s the market that drives the price.”

It’s also important to ensure that you have not overcapitalized your business. From an accounting perspective, the total enterprise value is the sum of all assets, inventory, and working capital. But, from a buyers’ perspective, there are additional different contexts to consider in valuing your business.

Buyers’ Perspectives

For example, if your inventory is more than 12 months, that is not valuable to the buyer anymore and should be deducted from the computed accounting value of the enterprise. If you’re an importer where your working capital needs are such that you have to fund suppliers overseas for your orders before they can reach you, and you have a 60-day credit line to your own customers, that would be considered by a buyer as not really part of your enterprise’s value since it requires more time to recover the funds, so it should be deducted as well. You are left now with only your assets as a real value offering. Therefore, from a buyers’ perspective, your business has been overcapitalized.

Speaking of assets, although the seller might use book value, insurance value, re-creation value, owners’ valuation, or a combination of all these as his basis for his enterprise’s asking price, buyers will look at the Realisable Value of its assets, based on what banks also do. Prospective buyers would consider if they can borrow against these assets to realize a better return on equity, and how much value they can recover if business performance was impaired.

When a buyer inquires about your profitability, there is also the question of which profit base to use. Using a 3-year historical data set of financial records for evaluation, should you use last year’s profits, or averages, or future estimated profitability? If your profit figures have been going down over the last 3 years, your buyer would prefer to use last year’s figures as a basis. If it has been going up, you would prefer to use last year’s figures as a basis. If your profit figures have been erratic, you might agree on averaging them. How about future estimated profitability? It would depend on many other external factors.

From an investment perspective, along the risk spectrum, buying businesses would be considered as a medium-to-high-risk investment option by a potential buyer, where 20% to 100% returns on investment (ROI) would translate to a multiplier of one to five times the profit base as a measure for valuation. More than five times as a multiplier would already put the business in the category of speculative investments for them.

Xcllusive Business Sales has a more detailed Valuation Pyramid Model which they discuss with clients in coming up with the right valuation for their enterprises. Depending on the business type and profit bases, multipliers are arrived at for appropriate valuation and subsequent pricing.

In addition to the financials, buyers also consider the non-financial but very important qualitative aspects of the enterprise for valuation. The following are considered as risk factors by potential buyers: too big exposure to a small number of clients, high reliance on skill and experience of the owner, high reliance on one key employee, highly competitive market, complete reliance on one supplier, unsecured tenancy, and uncertain cash flow.

On the other hand, buyers consider the following as value drivers: little reliance on the owner for the day-to-day management, the enterprise is a market leader in the industry, it has a desirable location or industry, there is good diversification of its products/services; there is under management; flexible working hours for the owner; the enterprise could be run from anywhere, and there are excellent sales and marketing systems or team in place.

Common Business Valuation Mistakes

Additionally, here are the common mistakes to avoid in business valuation: failure to interview the management and inspect the site; reliance on historical earnings and use only of average profits; managers’ wages are often not adjusted properly and always underestimated; following theoretical “rules of thumb” when in reality, each enterprise has unique circumstances; not making allowances for working capital and stock; double-dipping by adding goodwill to assets; and the incorrect use of the PEBITDA (Proprietor’s Earnings Before Interest, Tax, Depreciation, and Amortisation) vs. the EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation) in valuation.

Valuing Your Business Right And Preparing An Exit Strategy

In essence, valuing your business right involves basing it on solid and accurate information backed by evidence and not just your subjective assessment of your business’ value, so make sure your business operations are well documented. It also requires a correct understanding of the market situation and buyers’ perspectives. Furthermore, It needs taking into account correct financial valuation as well as the significant non-financial aspects of the enterprise.

In preparing for a future exit strategy, make sure that you are not overcapitalizing heavily on inventory and working capital because, in the end, these might work against your business’ value. Focus instead on investing in the real value drivers for your enterprise while minimizing and even eliminating the risk factors. For every expansion decision, always ask yourself: how will it affect your business’ value?

Credit: BusinessBrokers.com.au